The Central Bank of The Bahamas Digital Sand Dollar Set to be Fully Rolled Out during 2020

Since the establishment of the Central Bank of The Bahamas on June 1st 1974, the issuance of a Central Bank Digital Currency “Sand Dollar” is reckoned by some as its most innovative monetary initiative, and it is expected to be positively adopted throughout the country. The altruistic reasoning for the Sand Dollar hinges on its mission of financial inclusivity, payments interoperability and overall payments convenience throughout the archipelago forming The Bahamas.

The Sand Dollar’s pilot debuted on December 27th, 2019 in Georgetown, Exuma among some 1,300 participants, with another 1,800 waitlisted, and with 30 businesses with a Sand Dollar Point of Sale setup. This exceeds the intended size of the pilot project in Exuma of 500 participants. The pilot is expected to last six months. Exuma with a population of 7,314 was thought to be the perfect starting point. As it boasts, a healthy economy focused on tourism and is a microcosm of The Bahamas at large. The pilot project took the form of the participation of three payment services providers; the on-island commercial bank, and four money transmission businesses.

On the 28th of February 2020, the Sand Dollar made its second pilot release stop in the island of Abaco, and which was recently wrought by Hurricane Dorian during September 2019, and is currently in post hurricane economic recovery mode. It is notable that for the robustness of the Sand Dollar during all seasons, network infrastructure is being firmly established for post natural disaster recovery sites.

Finally, the Sand Dollar is projected to be released in the nation’s capital and nationwide during the second half of 2020. With the shocks of COVID-19, further digitization is thought to be timely.

The introduction of the Sand Dollar is timely and topical in the midst of a period when digital wallets have become prevalent for a range of digital assets globally and locally, when the proliferation of smart phones has become arguably commonplace, when regulators and policy makers have and continue to critically strategize appropriate legislation, and in the aftermath of Hurricane Dorian which destabilized standard banking activities on the island of Abaco.

The Central Bank provided an update on the Sand Dollar Project as a part of its mission to foster an inclusive dialog with the public, the financial institutions and the technology companies at a Power Breakfast event, jointly hosted by the Bahamas Chamber of Commerce and Employers Confederation (BCCEC) on Wednesday, February 12th, 2020 at the British Colonial Hilton. Several representatives from Equity Bank And Trust Bahamas participated, inclusive of Michael Dean, Director of Investment Funds, D. Gilbert Cassar, Head of Business Development and Fintech, and Sebastian Curry, AVP of Information Technology.

Although the Bahamas has swiftly shown prudential leadership in the unveiling of the Digital Sand Dollar as its Central Bank Digital Currency, it is notable that it is one of many renowned countries noted to be considering further monetary digitization inclusive of Canada, Haiti, Brazil, China, Curacao, St. Maarten, the Eastern Caribbean Central Bank, Malta, Norway and Singapore.

The Bahamas has been improving its network of banking facilities while navigating the challenge posed by an archipelagic range of islands and an unevenly spread populous. The Sand Dollar is seen by some to be the most inclusive approach. A few interesting statistics shared by the Central Bank at the Power Breakfast include that the growth in the ATM network has improved from 199 ATMs in 2012 to 252 ATMs in 2019. Within the local populous of roughly 350,000+ people according to the last 2010 census, online bank account users as of 2012 were 29,687 and in 2018 sat at 89,488, representing roughly 26% of the populous and representing an estimated 201% increase over that period. Given the proliferation of mobile phones, this trend is likely to continue, creating the fertile grounds for the Sand Dollar’s mission of enhanced financial access. Surveys revealed by the Central Bank revealed that roughly 90% of the population has a mobile device which is enabled and receptive. Also, 9 of every 10 people have a savings account, and 7 of 10 people have a debit card. Despite this, many people are currently still paid by cheque – which is subject to a multi-day clearing process. The Sand Dollar is meant to lead to instantaneous remittances, and significantly reduced costs for merchants.

The Governor of the Central Bank, Mr. John Rolle, noted that while embracing the enhanced inclusivity of the Sand Dollar that it was essential to model it that it “feels like cash” in its ease of use. He noted that the Central Bank therefore considers it the right of all people despite their status within The Bahamas, to have some level of access to the Sand Dollar and its digital wallet. This can be consider an altruistic human rights stance – as each person should be able to survive even undocumented and stranded, especially if the Sand Dollar becomes the preferred mode of commerce.

There will be parameters of Sand Dollar wallet usage according to tiers. Each tier will have a different level of Due Diligence “KYC” required, ranging from Simplified (Tier 1) requiring no significant formal identification, which would permit $500 to be maintained in the Sand Dollar digital wallet with maximum permissible volumes of $1,500 in spending per month, to Regular (Tier 2) requiring more KYC, which would permit $5,000 to be maintained in the wallet with up to $100,000 per year (or $10,000 per month) in transaction volume on a turnover basis being permitted, and finally to Enhanced (Tier 3) which would require enhanced KYC and permit $8,000 (or 1/20th of annual revenue) up to an annual limit of $1,000,000 to be maintained in the wallet with transaction volume limits of $20,000 per month or 1/8th of annual revenues (whichever is greater).

Re-assuring the public regarding the Central Bank’s backing of the Sand Dollar, Governor Rolle clarified that it is not a cryptocurrency and noting that “We’re looking at a digital representation of our currency. It’s not a different currency; it’s the same currency. In law, it will never be different. It can’t be differ in value in any way or the other so Sand Dollars can never be priced differently from Bahamian dollars”. Therefore, the footprint of the Sand Dollar is national. Nonetheless, the Governor insinuated pathways to convert Sand Dollars to foreign currency via an overt purchase and sale at foreign exchanges rates.

He continued that with key facets of the Sand Dollar being that, it would lead to fully auditable transactions, that it would leverage the use of QR codes that would be placed conveniently on an identification card for offline usage, and that it would allow for the use of alias names assigned to the identifier strings belonging to wallet users for practicality.

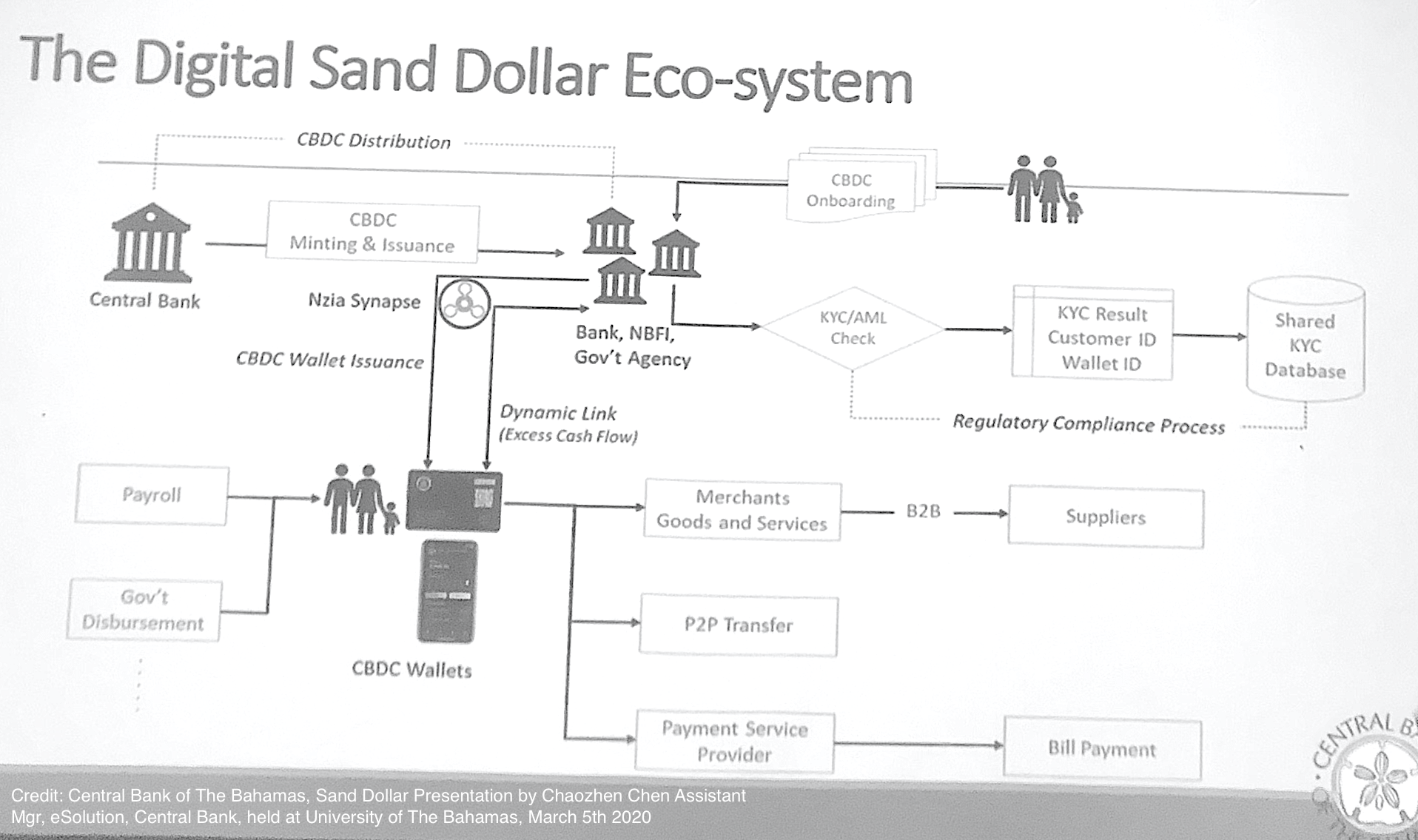

The participation of financial institutions is a part of the process for the administering of the Sand Dollar. Financial Institutions would enroll with the Central Bank as a Sand Dollar wallet provider, and upon approval, in turn would enroll wallet holders.

FinTech companies and the private sector are also welcomed to develop innovations for use cases for the Sand Dollar. Michael Dean, Director of Investment Funds, for instance, made a comment at the event regarding the usefulness of graphs and other data representations to assist everyday consumers with visualizing their behavior to make smarter decisions. Sebastian Curry, AVP of Information Technology also made comments regarding the importance of API (Application Programming Interface Usage) for the appropriate harmonization of the Sand Dollar wallet within websites to give birth to an ease of business with respect to e-commerce.

As shared in a presentation by Chaozhen Chen, Assistant Mgr., eSolutions, Central Bank of The Bahamas at an event held at the University of The Bahamas on March 5th 2020 entitled “Money Talks: Digital Assets in the New Era”, “Future Features and Innovations [of the Sand Dollar shall include]:

- Direct sweep to/from Bank accounts

- E-commerce; payment for government services and utility bills

- Enablement of micro-credit and automated payrolls

- Interconnectivity of remote banking relationships

- Management of family expenditures

- Shared eKYC

He also shared the following summarized benefits of the Sand Dollar: “

- Facilitate faster real-time transaction settlement

- Support Universal Access to banking and financing

- Create a virtually costless medium of exchange

- Enhance security and accountability

- Improve overall level of financial inclusion across the Bahamas

- Discourage nefarious and illegal activities with cash

- Enhance interoperability between banks

- Ensure adequate central bank money for the public

Summarizing Equity’s unwavering commitment to the Central Bank, D. Gilbert Cassar, Head of Business Development and Fintech, expressed the Company’s optimism about the digitization efforts: “We want to essentially be as cooperative as possible and complement the process. We fully support the Central Bank, and we’re looking for compliant ways to assist. Once those pathways become clear and enshrined, it seems to suggest that this process will complement rather than substitute financial intermediaries.”

Sources:

- https://www.cryptopolitan.com/bahamas-sand-dollar-2020/ (Published Dec 27, 2019)

- https://www.centralbankbahamas.com/news.php?cmd=view&id=16660 (Published Dec 24, 2019)

- The Tribune, Farah Johnson: Complete Bahamian Digital Sand Dollar Roll Out by Year-End, Thursday, February 13th 2020.

- Attendance at the Power Breakfast event, jointly hosted by the Bahamas Chamber of Commerce and Employers Confederation (BCCEC) on Wednesday, February 12th, 2020 at the British Colonial Hilton

- Attendance at University of The Bahamas Panel Discussion on March 5th 2020 entitled “Money Talks: Digital Assets in the New Era”

Governor of the Central Bank of The Bahamas, Mr. John Rolle