Markets Update

Bahamian & International Markets Overview

LionPress Spring 2020 Issue

Bahamian Market, as at March 2020

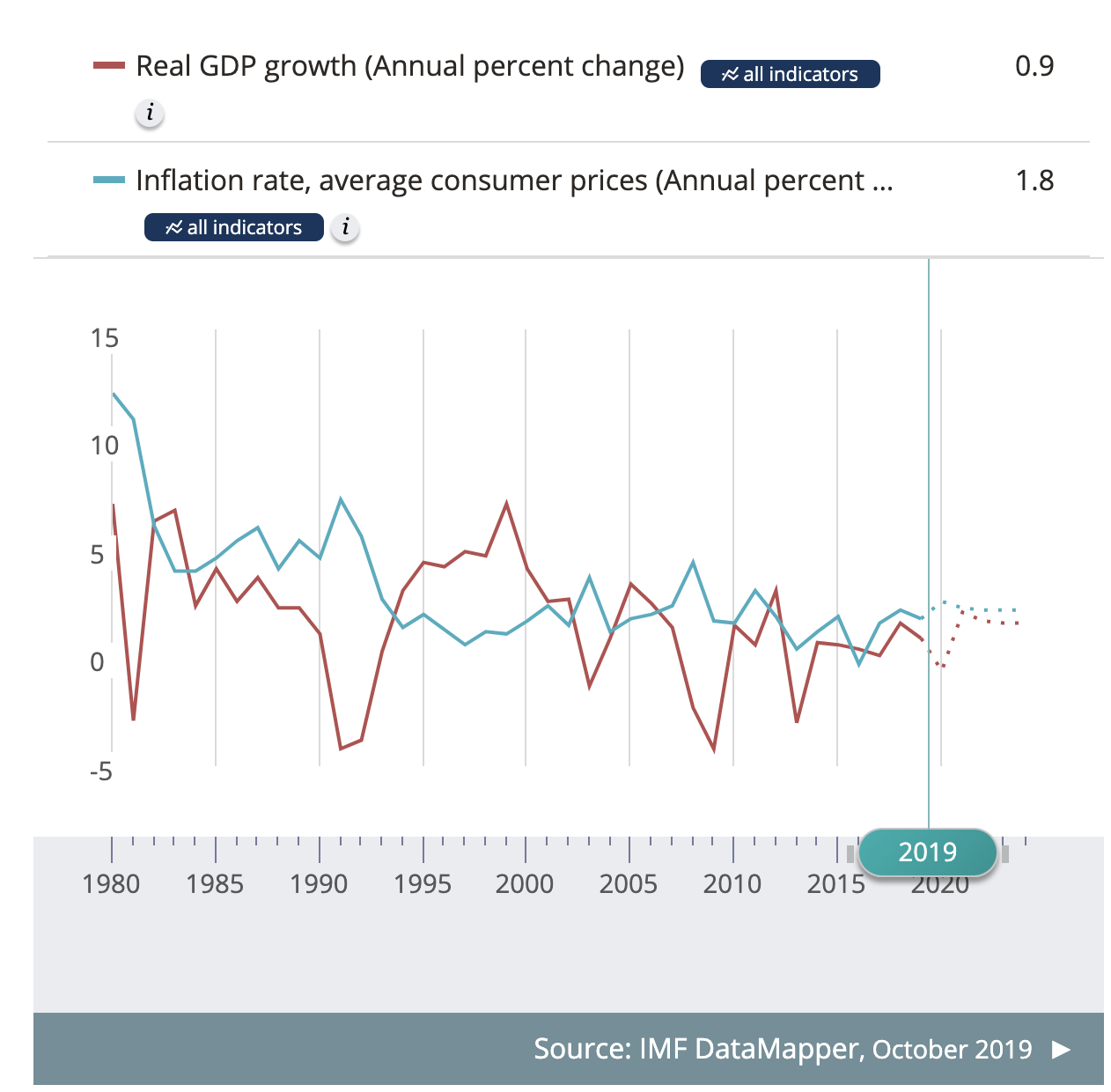

From a macro perspective, the size of the economy modestly increased as measured by total output reflected in the real Gross Domestic Product growth rate, adjusted for inflation. According to statistics published by the Central Bank of The Bahamas, in 2019 there was a real GDP% increase of 0.9%, tapering off from a 2018 real GDP% increase of 1.6%. By way of comparison, the Bahamas’ 2019 0.9% real GPD rate was equivalent to that of Japan and outpaced Germany’s 2019 real GDP of 0.5%. China led the way in real GDP growth in 2019 with a rate of 6.1% (lower than usual due to the US-China trade war)and followed by the US with a 2019 real GDP growth rate of 2.4%.

Here is a graph from the International Monetary Fund (IMF) of which the Bahamas has been a member since August 21st, 1973, on the real GDP Growth in the Bahamas:

A closer look at the Caribbean nonetheless still shows the Bahamas among the higher ranks in GDP per capita.

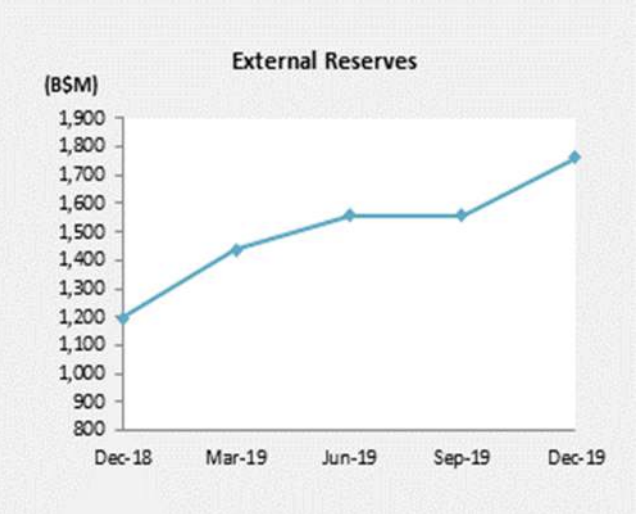

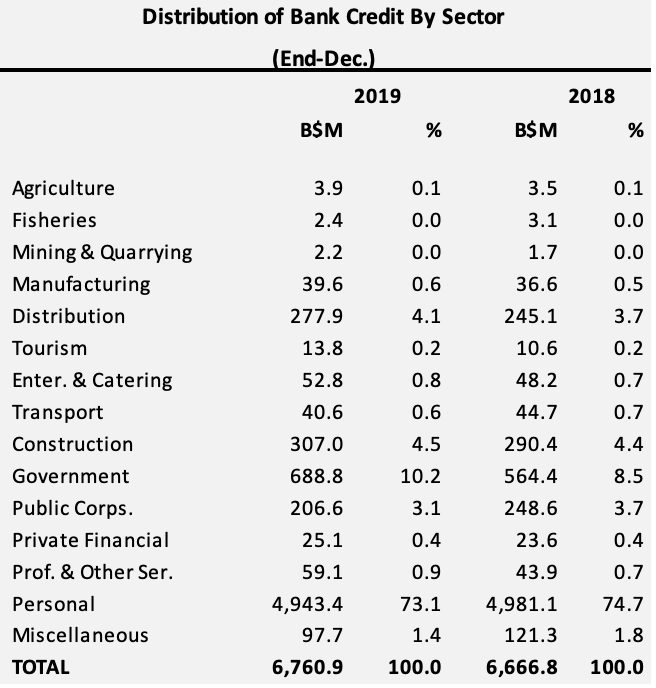

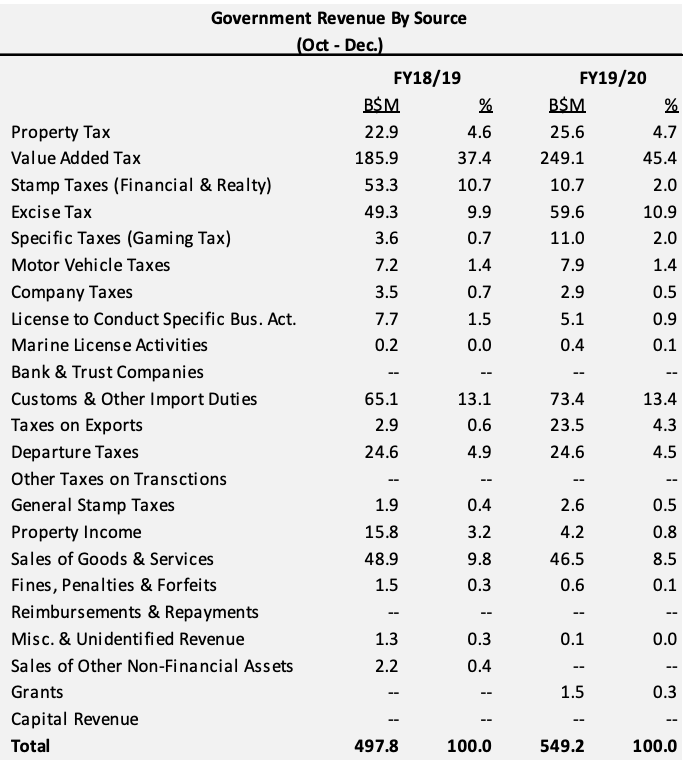

The IMF predicts that real GDP for 2020 in The Bahamas to be -0.6%, reflecting a slight contraction. This is thought to be due to the devastating Hurricane Dorian that made landfall on September 1st 2019, which wrough havoc on the islands of Abaco and Grand Bahama. The Government’s hurricane focused expenditures outpaced revenue collection during the first half of FY2019/2020. This has led to a modest widening of the national deficit despite initial perceived austerity efforts. Nonetheless, overall bank liquidity continues to expand reflecting an upward trending depository base and a tightening of domestic credit given more precautionary lending practices. A break down on the allocation of existing credit from provide below from the Central Bank of The Bahamas, Quarterly Economic Review, Vol. 28, No. 4, December 2019, published March 17th 2020.

As of 2019, the inflation rate sat at 1.8% as a measure of general price increases in the Bahamian economy. Unemployment improved, however, remains an issue to be addressed, deescalating from a rate of 10.7% in 2018 to 9.5% in 2019, reflecting a 10.2% decrease. An unemployment rate comparison is the Euro-Area with a rate of 7.7% as on 2019.

This IMF graph shows the changes in the inflation rate in The Bahamas over time vis-a-vis the real GDP rate:

As of January 2020, the official interest rate of the Central Bank of The Bahamas has consistently sat at 4% since September 2017.

As of January 2020, the local stock exchange BISX (Bahamas International Securities Exchange) over a 12-month term saw positive growth of 7.7% as compared to a 4.55% increase of the FTSE 100 (based on the 100 largest market cap companies on the London Stock Exchange) over the same term and as compared to a 19.28% percentage of the S&P 500 over the same period. This signals progression in Bahamian publicly listed business on BISX during that period.

Tourism levels remained positive despite Hurricane Dorian driven by visitor arrivals in New Providence and unaffected family islands. Total foreign arrivals during the month of December 2019 grew by 5.3% from the previous month driven by sea arrivals, as compared to a 10% MoM growth in December 2018, hence positive but with less momentum. Overall for 2019 total visitor arrivals set a record setting growth rate of 9.4% - being the highest in nine years – a step up from the also impressive growth during 2018 of 7.9%. The 2019 outcome is a result of 10.3% increase in the sea segment (outdoing the 5.5% increase achieved during 2018) and a 6.9% increase in the air segment (which is positive news but not as exponential as the 16.7% enlargement of the air arrivals in 2018). So far for 2020, January statistics by the Nassau Airport Development Company Limited (NAD) for the country’s main port of entry show an uptick of 6.1% (net of domestic passengers), within which is a growth in US departures by 6% and other international departures by 6.4% - more mild increases than in the comparative period during 2018, but nonetheless positive. Tourism, since, has been severly disrupted by the advent of COVID-19.

COVID-19 certainly is a concern for the Bahamas as if it fails to be contained and quarantined globally, this would impact worldwide economic activity and travelling appetites for a prolonged time until there is a meaningful cure or the disease disappates and a contagion threat. This irectly affects The Bahamas’ number one industry, tourism. As reported by EyeWitness News on March 2nd 2020, there were no suspected, reported or confirmed cases of the Coronavirus in the Bahamas. However, as of Sunday March 29th, in a statement by the Right Honorable Prime Minister Hubert Minnis indicated that the total confirmed cases of COVID-19 has since escalated to 14, despite many heightened protocols around free movement in The Bahamas. The Government is making diligent efforts to avoid any cases locally. The Right Honorable Prime Minister Minnis is as Doctor by profession and said “I want to be clear, when it comes to public health threats, the government will not take any chances”. He further shared that the Ministry of Health has formulated an astute national preparedness and response plan to manage the threat and appropriate responses to it. Moreover, he noted that the government is instituting a national coordinating committee with key stakeholders and participants. The government has since announced relief funding targed at affected Tourism Workers and the Central Bank has issued an advisory to the public on March 24th 2020 entitled "Deferral of loan payments for borrowers displaced by COVID-19 Pandemic" in which it annouced an arrangement with banks and credit unions to provide a "3-month deferral against repayments on credit facilities for businesses and households that were negatively impacted by the COVID-19 pandemic".

During April 2019, the Bahamian government entered into a $100m loan with the Inter-American Development Bank for the purpose of the establishment of a Contingency Fund. An EyeWitness news article publish on March 4th, 2020, notes that $25m of this Contingency Fund has been expended on Hurricane Relief expenditures, and that $4m was sought from it by the government to be allocated to the Ministry of Health for additional resources in response to COVID-19.

As reported by the Tribune on March 19th 2020 based on remarks from the Deputy Prime Minister and Minister of Finance, COVID-19 is projected to cause $1bn is losses to the Bahamian economy in the four months leading up to June 2020. This is in addition to the $3.4bn hit from Hurricane Dorian in losses and damages. He also shared that the Ministry of Finance is nonetheless assured for the time being that it is capable of withstanding and overcoming the anticipated direct impact of the $147m COVID-19 related fiscal blow. This is made possible due to a recently approved additional net borrowing amount of $508m, taken on for the purpose of Hurricane Dorian rebuilding efforts. Nevertheless, it is not the government's intention to extend the post-Hurricane Dorian deficit, and rather, it is committed to staying within this $677.5m deficit limit by re-ordering priorities.

Re-affirming the government's dedication to the meeting the fiscal challenges at hand due to Hurricane Dorian and COVID-19, the Deputy Prime Minister, the Honorable Peter Turnquest, says “It’s a very significant challenge. These are issues that we could not have originally planned for - even with the supplementary budget - but we have to reprioritise and rearrange our finances to ensure we meet our commitments and the needs of the Bahamian people."

We hope that financial services and most businesses will continue to operate remotely and with skeletal staff on the ground in a compliant manner, and that the solution to this disease arrives soonest to ease the burden on the tourism industry particularly and the overall country. ■

International Markets, as at March 16th, 2020

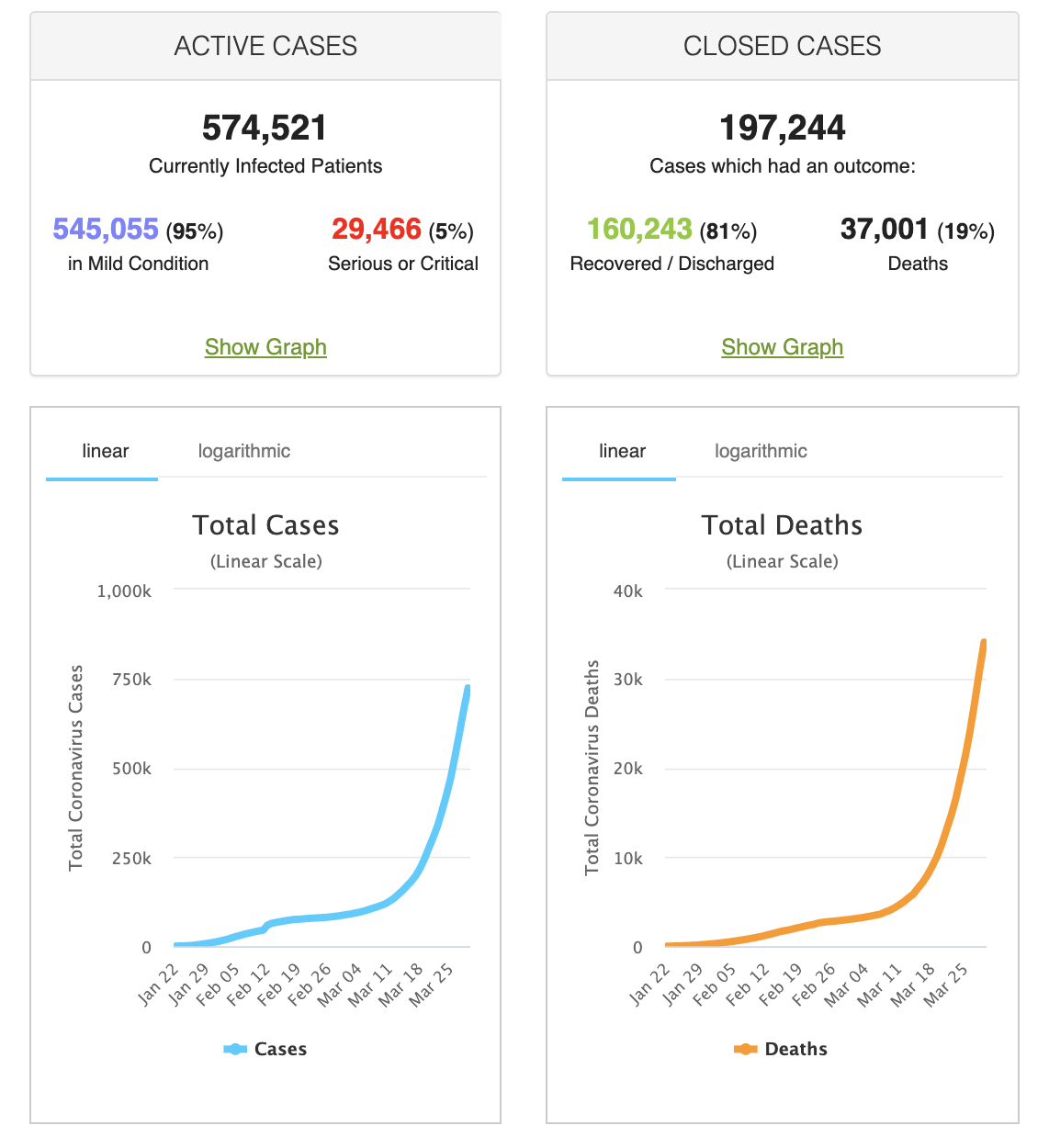

Global markets have been in disarray as a result of COVID-19 and on the heels of the China-USA Trade war. The infectious disease is reported by CNBC to have outpaced the death toll of the earlier Sars corona virus strain, and although statistics indicated that 3.4% of those affected end in demise (according to the World Health Organization as of March 3rd 2020) as compared to the 7%-range mortality rate of Sars, COVID-19 is more viral and has become a pandemic. As of March 30th 2020, according to Worldometer, there are globally 771,765 cases of COVID-19 of which there are 37,001 deaths and 160,243 persons who have recovered. Please see the Worldometer graphs below as of March 30th 2020:

The elderly and immuno compromised are especially at risk, and the virus is still without a cure and is still being studied by experts, who have acknowleged that in certain conditions it may even be airbourne. This global scare has resulted in social distancing measures and quarantine protocols that continues to impact world trade negatively, disrupt global supply chains, halt the transportation industry to a significant extent, and depress overall commerce. Numerous businesses have been forced to close their facilities in respect of governmental safety orders, and as a result of massive forgone revenues, these businesses have had to lay off workers and cut wages to various degrees. This of course through a mutiplier effect causes consumer demand to weaken due to a smaller disposable income and a growing uncertainty as to future income. In attempts to combat the prospects of a recession, governments have been trying to boost consumer spending through a low interest rate environment and stimulus subsidy packages to the most vulnerable and impacted; however, the resources of governments to sustainably propt up the economy in this way for such mass reach is questionable from country to country. It is a well known finding that countries must spend themselves out of a recession to get commerce flowing smoothly, and therefore low interest rates are thought to encourage borrowing at favourable rates for this purpose.

On Sunday, March 15th 2020, Chairman of the US Federal Reserve, Jerome Powell noted that to assist the US economy it would be slashing the Fed's benchmark interest rate to nearly zero and buying $700Bn in mortgage-backed securities and treasury to inject additional liquidity into the banks. Reporters note that the Fed has not done something this extreme since the 2008 financial crisis. Quantitative easing is also being used by the Bank of England, as the central bank has announced that it will loan an additional £200bn to the UK Government.

While Disney, Apple, Nike and several giant companies have recorded considerable impact from disrupted facilities and production, some companies are positioned to excel given their remote nature or necessity status, namely delivery companies, food stores and online e-commerce businesses generally. This surge in disproportionate demand for these services have influenced businesses to become more digital to evolve with the needs of the current times.

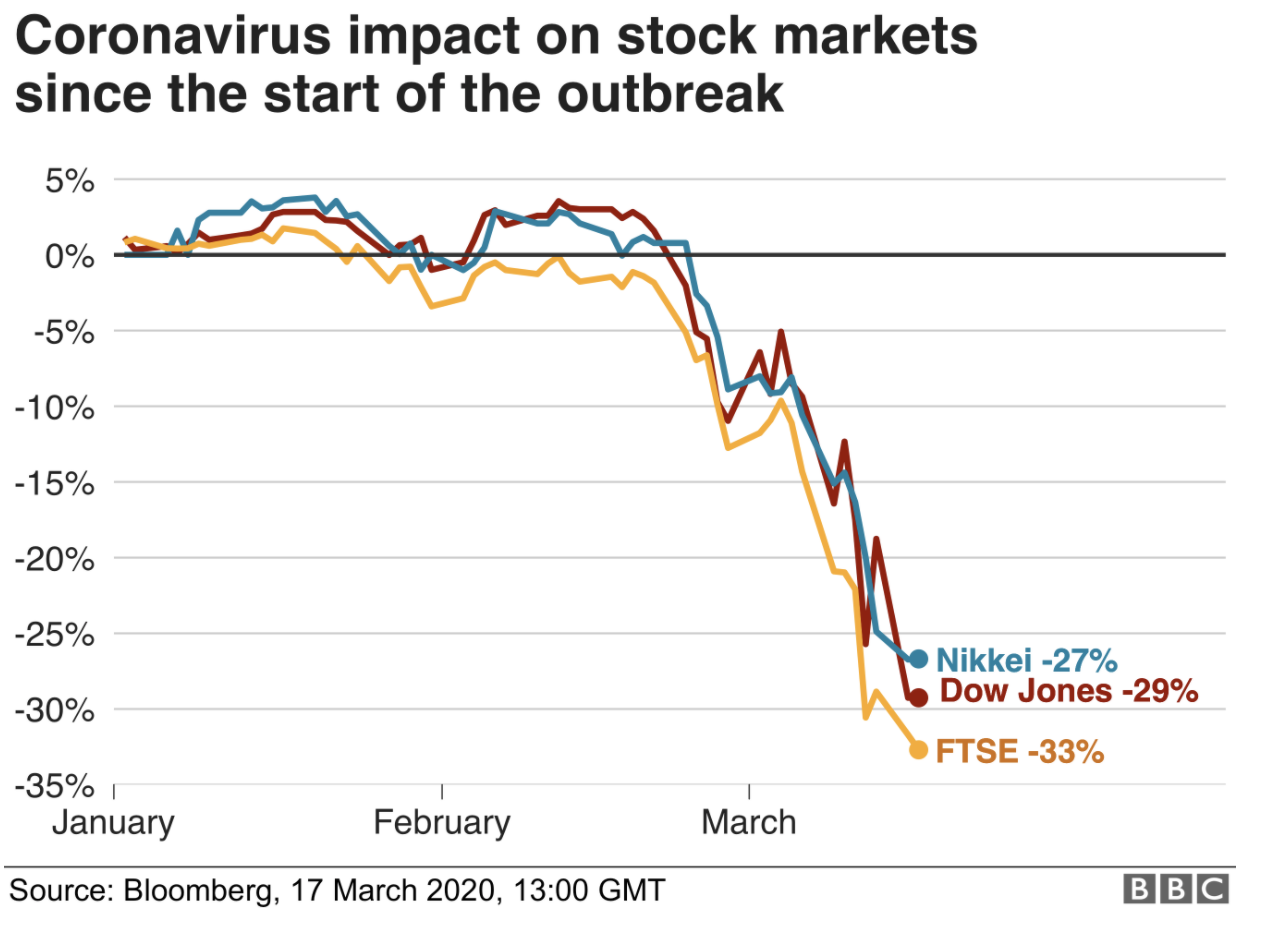

General anxiety about the markets has caused panic selling of equities on stock exchanges, because of the bearish shock that has been dealt to many publicly traded businesses' earnings and the downgrading of analyst expectations. However, some investors such as Warren Buffet and Berkshire Hathaway caution a short term approach to trading shares, and rather remind stock market participants that stocks are no more than pieces of businesses who in the medium to long-term tend to weather even the worst of storms, and drew a comparison of COVID-19's market impact to that of Black Monday on October 19 1987, which he noted that he found to have been even worse in an interview on March 10th 2020 held by Yahoo Finance. He continued that it may open opportunities ironically for undervalued businesses to be bought at attractive prices, and that generally one should look at the fundamentals of a business rather than the emotion of the market.

Nonetheless, it is unignorable that on March 9th 2020 Bloomberg reports that the DOW Jones Industrial Average was down 2000 points, and the price per barrel of oil hit a low of $30 per barrel marking the largest decline in oil prices since the Gulf War in 1991 as Saudi Arabia and Russia engage in a "game-theory" standoff during the midst of the COVID-19 pandemonium. The demand from China for oil is down given the COVID-19 impact on their ecnonomy, and hence it is not sustainable to oversupply the market at such low prices. 10-year bonds also reported a less than 0.5% coupon rate. To explain the bad timing of the oil pricing war more eruditely, in reaction to waning demand for oil given COVID-19 industry contractions, to stablize the oil markets OPEC sought for Russia to join the effort in curbing oil production. She refused and her additonal production led to a 11% drop in oil prices, to which Saudi Arabia retored with even an steeper price drop, ultimately thought to be as a pressure tactic and or a race for market share. Russia since is reported to be considering further production increases in April 2020, which will further driver oil prices lower. This sends a global rippling effect.

Markets Insider reports that at the close of Markets on Monday, March 9th, 2020, due to both COVID-19 and the Oil Price War:

- S&P 500: 2,746.56, down 7.6% (most severe single-day decline in approximately 12 years. After declining 7% in mere minutes there was a temporary stop of trading)

- Dow Jones industrial average: 23,851.02, down 7.8% (2,013.76 points) (largest single-day decline since the 2008 financial crisis)

- Nasdaq composite: 7,950.68, down 7.3%

Governments are staying informed regarding the latest health updates and through quarantine measures are trying to prevent overwhelming the health care sector and available medical resources. Scientists continue to work towards a vaccine to fight against COVID-19. In the meanwhile, we shall watch the markets and hope that businesses can reinvent themselves and that the most important supply chains remain open for food and medical supplies, and ultimately that markets eventually rebound.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE VIEWS, STRATEGIES AND FINANCIAL INSTRUMENTS DESCRIBED IN THIS ARTICLE MAY NOT BE SUITABLE FOR ALL INVESTORS. OPINIONS EXPRESSED ARE CURRENT OPINIONS AS OF THE DATE(S) APPEARING IN THIS MATERIAL ONLY.

THIS DOCUMENT DOES NOT CONSTITUTE AN OFFER OR SOLICITATION TO ANY PERSON IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION IS NOT AUTHORIZED OR TO ANY PERSON TO WHOM IT WOULD BE UNLAWFUL TO MAKE SUCH OFFER OR SOLICITATION. ANY REFERENCE IN THIS DOCUMENT TO SPECIFIC SECURITIES AND ISSUERS ARE FOR ILLUSTRATIVE PURPOSES ONLY, AND SHOULD NOT BE INTERPRETED AS RECOMMENDATIONS TO PURCHASE OR SELL THOSE SECURITIES.

Sources:

- https://www.theguardian.com/business/2020/mar/28/how-coronavirus-sent-global-markets-into-freefall

- https://www.theguardian.com/business/2020/mar/15/federal-reserve-cuts-interest-rates-near-zero-prop-up-us-economy-coronavirus

- https://www.theguardian.com/business/2020/mar/28/coronavirus-bailouts-need-to-be-paid-back-or-do-they

- https://qz.com/1825248/what-nike-learned-in-china-during-the-coronavirus-outbreak/

- https://www.scmp.com/comment/opinion/article/3077302/oil-industry-nears-collapse-saudi-arabia-may-have-no-option-blink

- https://www.bloomberg.com/news/articles/2020-03-08/yen-slides-as-oil-price-war-adds-to-global-worries-markets-wrap

- https://ewnews.com/govt-seeking-4-million-contingency-fund-for-coronavirus-response

- http://www.tribune242.com/news/2020/mar/19/44bn-economic-blow-playbook-out-window/

- https://markets.businessinsider.com/news/stocks/stock-market-news-today-indexes-plunge-oil-market-coronavirus-selloff-2020-3-1028978137

- https://markets.businessinsider.com/commodities/news/oil-price-war-outlook-stock-market-impact-opec-russia-saudi-2020-3-1028977635?utm_source=markets&utm_medium=ingest

- https://www.worldometers.info/coronavirus/coronavirus-death-rate/

Central Bank of The Bahamas, Quarterly Economic Review, Vol. 28, No. 4, December 2019, published March 17th 2020

Central Bank of The Bahamas, Quarterly Economic Review, Vol. 28, No. 4, December 2019, published March 17th 2020

Central Bank of The Bahamas, Quarterly Economic Review, Vol. 28, No. 4, December 2019, published March 17th 2020