Highlights in the US Market in Summary (up to May 24th, 2019)

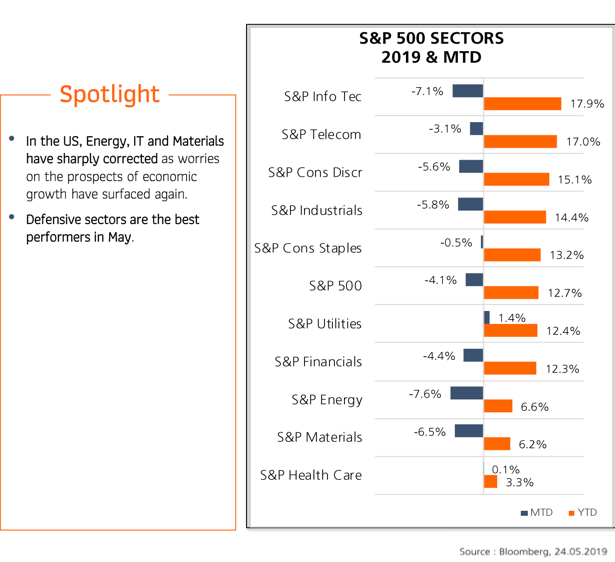

As of the close of May 24th the S&P 500 is -4% MTD and +12.7% YTD, and the MSCI World is -4.4% and +10% YTD.

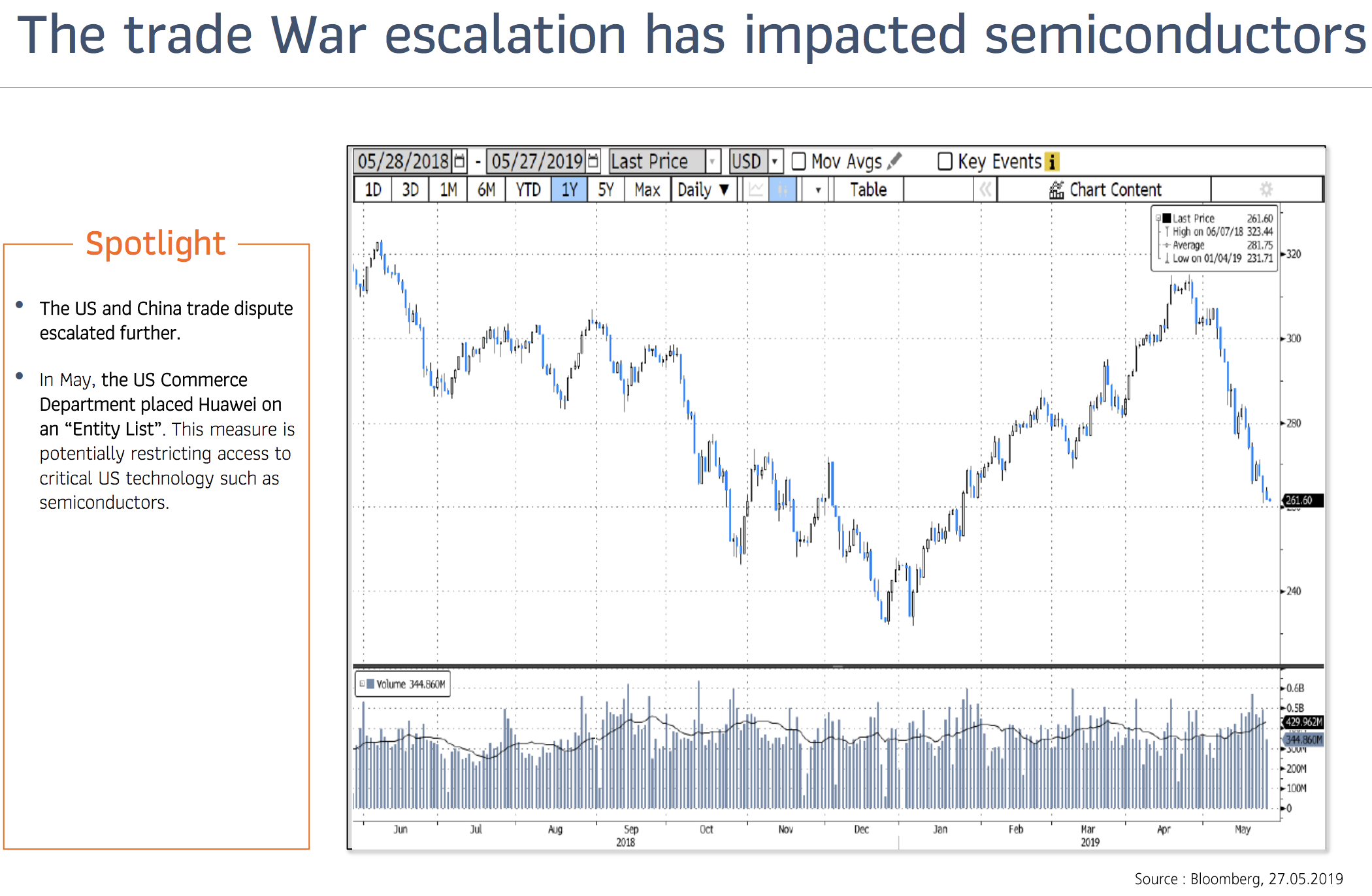

- After touching the all-time-high of 2945 at the end of last month, US equity markets (S&P 500) have corrected around -4% led by the negative headlines on the back of trade war fears, ignited by the decision of the Trump administration to impose higher tariffs to Chinese imports. The growing list of collateral damage from the ongoing US/China Trade War, extended to ZTE, Huawei, HIKVision, their related supply chains, and, even pandas from the San Diego Zoo (yes, China is demanding Pandas loaned to the San Diego zoo, back).

- Since Trump announced that the rate on $200bn of goods imported from China would increase to 25% on May 10th, the S&P is just down -3% —probably giving us some clarity of the positioning picture, as investors seem to have been already fairly well hedged versus what we saw during the tumultuous times of 4Q18. Frankly the fact that it was not down more, has surprised us, in the face of generally negative news flow.

- Looking back to where we were in the last IC, it is truly amazing that a few inflammatory tweets can change sentiment so drastically. We’ve gone from a US/China deal being fairly consensus just a few short weeks ago, to a near-term resolution being speculative at best. Based on the news flow it sounds like many believe we could be in for a long, drawn out process.

- President Trump’s tariffs were initially seen as a tool to force other countries to drop their trade barriers, but they increasingly look like a more permanent tool to shelter American industry, block imports and banish an undesirable trade deficit. More than two years into the Trump administration, the United States has emerged as a nation with the highest tariff rates among developed countries, outranking Canada, Germany and France, as well as China, Russia and Turkey.

- Beneath the surface, the market has been more discerning and internal rotations continue to support the index, as price action paints the moremcautious picture. Last week saw continued rotations out of Cyclicals (-4.3% on the week) and into Defensives (+1.2% on the week). Also, since May 3, S&P Utilities are up +2.1%, while Consumer Discretionary and Info Tech led the way down, -5.8% and -7.2% respectively. Bottom-line, it appears as though investors are taking a step back to say “Let’s not be out of them market but let’s be thoughtful.”

- The picture on US inflation might also be changing. Tariff escalation risk has risen and each progressive tranche of tariffs increasingly affects consumer goods. The final tranche is 68.5% consumer goods & auto/parts—the highest percentage of the three tranches. It is possible that inflation markets have not yet priced in the impact of tariffs, and instead appear complacent. Analysts at Morgan Stanley find that the 10% tariffs last September likely added 10bp to CPI, and extrapolation would suggest 25% tariffs could be worth 25bp on CPI.

- While consumer goods bear the brunt of the trade-related supply chain impact, it does not stop there. Many view tariffs could cost 1.0%-1.5% of net income for the S&P 500 for 2019. Key sectors at risk include US (IT hardware, Hard and Soft Goods, Autos, & Auto Suppliers), EU (Capital Goods), and Asia Tech, Asia Autos & Auto Suppliers, China Transportation, which are expected to face clear earnings headwinds should escalation continue. Within this, examples of companies globally that are likely to be impacted by trade tariffs are numerous. In the US, among IT names, Apple (AAPL) is most exposed to production in China, along with Seagate Technology (STX), HP (HPQ) and Sonos (SONO). Meanwhile, in the auto sector many have grown more concerned about Tesla (TSLA) and in the machinery side, companies like Caterpillar (CAT), PACCAR (PCAR), and Terex Corp (TEX) have seen some form of supply chain disruption (but have primarily looked at price increases to offset).

- The impact of higher tariffs will inevitably be felt to varying degrees across the sector / sub-sector landscape. Another sector to be paying particular attention to is Global Retail, which has recently come into focus given the sector exposure to the next leg of tariffs, as well as recent earnings misses—Kohl’s (KSS), Foot Locker (FL), Inditex (ITX) and Lowe’s (LOW). The debate, now, is to what extent the all-encompassing tariff theme will further force thinning margins across this space. With a tight labor market, rising wages, and the battle for consumer wallet share between “bricks” and “clicks” raging on (and subsequently the need for last-mile shipping solutions), it’s well-documented that retailers’ margins have already endured considerable erosion.

- Include the re-escalation of tariffs, and profit margins are once again likely to absorb most of the impact once costs can no longer be passed along to consumers. Anecdotal evidence supports this claim, as commentary from the Dallas Federal Reserve in October of last year cited; “Among manufacturers, roughly 60 percent of contacts said the tariffs announced and/or implemented this year have resulted in increased input costs. The share was even higher among retailers, at 70 percent. Several contacts noted lower profit margins resulting from not being able to raise selling prices enough to offset the full cost hikes.”

- In a scenario that tariffs of 25% are imposed on nearly all goods imported from China, many additional retailers would face strong negative earnings impact.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE VIEWS, STRATEGIES AND FINANCIAL INSTRUMENTS DESCRIBED IN THIS ARTICLE MAY NOT BE SUITABLE FOR ALL INVESTORS. OPINIONS EXPRESSED ARE CURRENT OPINIONS AS OF THE DATE(S) APPEARING IN THIS MATERIAL ONLY.

THIS DOCUMENT DOES NOT CONSTITUTE AN OFFER OR SOLICITATION TO ANY PERSON IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION IS NOT AUTHORIZED OR TO ANY PERSON TO WHOM IT WOULD BE UNLAWFUL TO MAKE SUCH OFFER OR SOLICITATION. ANY REFERENCE IN THIS DOCUMENT TO SPECIFIC SECURITIES AND ISSUERS ARE FOR ILLUSTRATIVE PURPOSES ONLY, AND SHOULD NOT BE INTERPRETED AS RECOMMENDATIONS TO PURCHASE OR SELL THOSE SECURITIES.

Sources: Global Reflections, by Nick Savone, Morgan Stanley, May 24th 2019; Octogone